S&P 500’s 7 shooting stars. Here are 7 growth stocks that outperformed the S&P 500 in 2024. These growth stocks outperformed the S&P 500 this year.

WMT: Walmart Walmart beats competitors with low prices in many categories. Cloud computing and advertising are booming for Amazon (AMZN).

2024 Emmy nominees are “The Bear,” “Shogun,” & “Baby Reindeer”

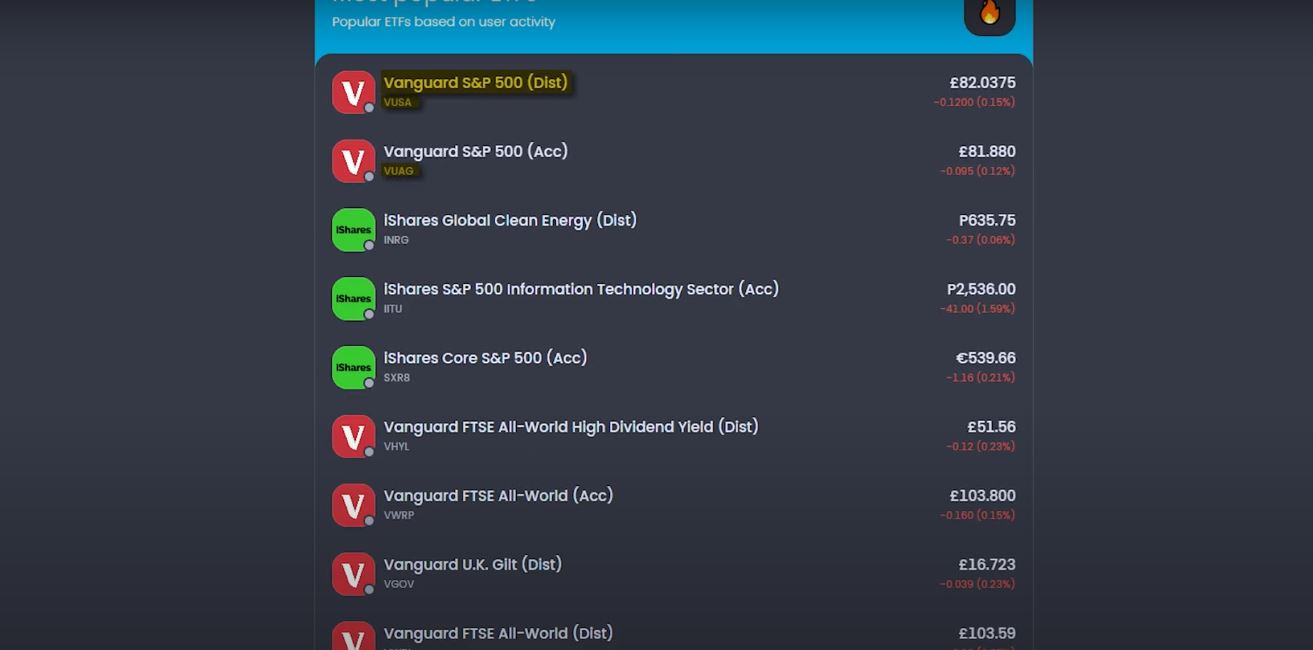

NU Holdings: A digital bank has reached 100 million customers. S&P 500 represents portfolio diversification. This index is what most investors mean by “beat the market.” It holds 500 profitable public companies, weighted by market cap. For instance, investors will have the highest exposure to the largest publicly traded company and the least to the 500th largest.

S&P 500 Getting into the S&P 500 is difficult. Companies must have a sufficient market cap and record a profitable year. Many investors utilize index investing to mirror the market, but you can beat the S&P 500.

These growth stocks have outperformed the S&P 500. Investors may want to examine these growing stocks. S&P 500 represents portfolio diversification.

This index is what most investors mean by “beat the market.” It holds 500 profitable public companies, weighted by market cap.

For instance, investors will have the highest exposure to the largest publicly traded company and the least to the 500th largest.

Getting into the S&P 500 is difficult. Companies must have a sufficient market cap and record a profitable year.

Many investors utilize index investing to mirror the market, but you can beat the S&P 500.

These growth stocks have outperformed the S&P 500. Investors may want to examine these growing stocks.

Without mentioning one of the Magnificent Seven stocks, outperforming the S&P 500 is difficult. Their effect on the Nasdaq Composite has propelled the index for years.

Amazon (NASDAQ: AMZN): It is a Magnificent amongst Seven growth stocks with a 30% year-to-date return. Double-digit revenue growth in local and international online marketplace sales continues.

Q1 2024 results have other highlights. The company announced 17% revenue growth for Amazon Web Services and 13% revenue growth overall.

That Amazon division earned $25.0 billion in the quarter. E-commerce and cloud computing are Amazon’s expertise, but the corporation is growing in advertising.

Ad revenue rose 24% to $11.8 billion this quarter for the internet titan. Amazon excels in several businesses, which should benefit patient investors.

Nu Holdings (NYSE:NU): A Brazilian digital bank, providing a variety of financial services to Latin Americans. Shares are up 65% year-to-date. The company recently reached 100 million active users, which helps. First-quarter activity at the digital bank was 83%.

This shows that 83% of the company’s 100 million consumers are active monthly. Over 83 million monthly active customers use numerous financial products from the bank.

Personal loans, credit cards, bank accounts, brokerage accounts, and other services helped Nu Holdings generate sales 69% year-over-year. Wall Street experts expect the stock to climb.

Seven analysts recommend it as a Strong Buy with a 5% upside. The stock might gain 13% at the $15.20 high objective.

Chipotle (NYSE: CMG) For a number of years, It has outperformed the stock market. Following a recent 50-for-1 stock split, the Mexican Grill chain has experienced a correction.

Long-term investors have an opportunity with this correction. In the first quarter, revenue climbed by 14.1% year over year to $2.7 billion, while net income surged by 23.2% year over year to $259.3 million.

This quarter, Chipotle added 47 new locations, and the company is still on track to open 285–315 locations this year.

The growth of Chipotle’s restaurant business is not the sole factor driving its revenue increase. Comparable restaurant sales increased by 7.0% year over year, according to the firm.

The highest price goal of $80 per share shows that a 38% gain may occur, while the average price target points to an upside of 16%.

Another Magnificent Seven stock that has beaten the S&P 500 over an extended period of time, including this year.

META (NASDAQ:META) The parent company of Facebook has gained 44% so far this year and offers a 0.40% yield.

The stock is valued at $1.26 trillion and has a P/E ratio of 29. With 3.24 billion daily active users at the end of the first quarter, the social media behemoth surpassed the corresponding period in the previous year by 7%.

Because of its vast user base, Meta Platforms is able to test out new goods and AI services.

The business operates effectively under its current business model even while it works on new projects. While net income jumped by 117% annually, revenue climbed by 27% annually.

Wall Street continues to love Meta Platforms. The stock is expected to rise 6% from present levels and is recommended as a Strong Buy. With a price objective of $625 per share, the company may rise by a further 25%.

Texas Roadhouse (NASDAQ:TXRH) It is a smaller chain of steakhouses than Chipotle, it is growing and is valued more fairly. The stock yields 1.44% and is trading at a 34 P/E ratio. The share price has increased by 42% so far this year and has more than tripled in the previous five years. In the first quarter, the chain of steakhouses reported a 12.5% increase in revenue year over year. The company’s net income increased by 31.9% in comparison to the previous year, which could support its dividend growth rate of double digits. During the quarter, Texas Roadhouse opened 12 locations, including three franchises. Comparable sales at the chain of steakhouses saw an 8.4% yearly rise at its company-owned locations. For franchise eateries, the growth rate was 7.7%. These growth rates are commendable and show that Texas Roadhouse is establishing itself as a mainstay in many areas. Analysts on Wall Street have assigned a Moderate Buy rating to the stock. The maximum price goal of $191 per share indicates a potential 13% gain, whilst the average price target only shows a 3% upside.

Crowdstrike (NASDAQ:CRWD) The cybersecurity company has delivered a 50% rise year-to-date and was recently added to the S&P 500. almost the previous five years, shares have increased by almost 400%.

The growth of the industry will benefit many businesses, but few are in a better position than Crowdstrike. Crowdstrike is pushing on while other cybersecurity firms have reported slowing revenue growth.

With a subscription business model, Crowdstrike generates $3.65 billion in recurring income annually.

From $0.5 million in the same period last year to $42.8 million this quarter, profits are likewise skyrocketing. Marc Guberti had long positions in AMZN, TXRH, and CRWD as of the publication date.